Ratekhoj

Calculate maturity amount and interest earned on your PPF Account.

PPF balance (with interest) over the year

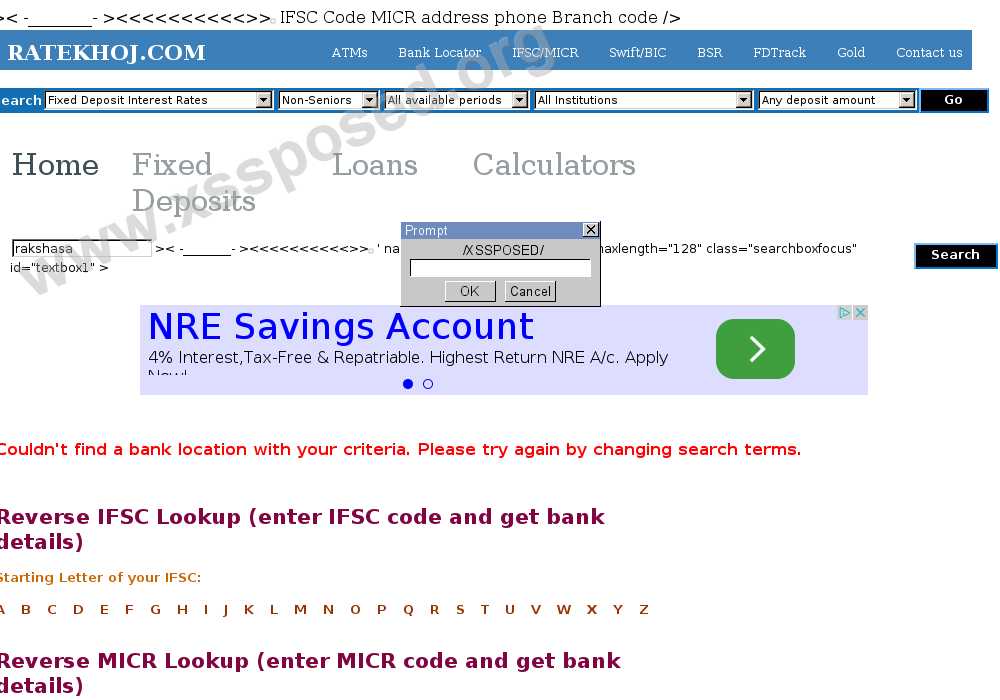

- AXIS BANK Branches, Tripura, All Branch Addresses, Phone, IFSC code, MICR code, Find IFSC, MICR Codes, Address, All Bank Branches in India, for NEFT, RTGS, ECS.

- The latest tweets from @ratekhoj.

Ratekhoj.com is a moderately popular website with approximately 92K visitors monthly, according to Alexa, which gave it an ordinary traffic rank. Moreover, Ratekhoj has yet to grow their social media reach, as it’s relatively low at the moment: 67 StumbleUpon views, 29 Facebook likes and 20 Twitter mentions.

Closing Balance is displayed left (skyblue color) and the Interest Earned on right (green color) for each year.

Total Amount Deposited as compared to Total Interests Earned

Final Maturity Amount is .

PPF Calculator is a simple online tool for PPF related calculations. If you're saving/investing money under PPF scheme, then you may find this little tool useful for doing some calculations e.g interests earned over the period or how your investment grows over the years, final maturity amount etc. Just enter the yearly deposit amount and it calculates (also show you the table and chart) your interest/balance for the next 15 financial years.

Ratekhoj Hdfc

What is PPF ?

PPF (Public Provident Fund) is a saving-cum-tax saving scheme in India (started in 1968 by National Saving Institute of the Ministry of Finance) by Central Government. The goal is to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits. (Tax exemption : EEE)

The interest rate is 7.10% per annum (compounded annually) and it's tax free (contribution under 80C and interest earned is fully exempted without any limit). Anyone individual Indian resident(including minor but not NRIs) can open an account with any nationalized bank (SBI, PNB, Central Bank of India etc) or post office or some authorized private banks (ICICI, HDFC, Axis Bank etc). The duration is 15 years and one can deposit anywhere between Rs. 500 (minimum) to 1.5 lac (maximum) per year.

Facts About PPF

- Current interest rate : 7.10%

- Duration of scheme : 15 years

- Minimum deposit amount (per year) : 500

- Maximum deposit amount (per year) : 1,50,000

- Number of installments every year : 1 (Min) to 12 (Max)

- Number of accounts one can open : Only One

- Lock-in period : 15 years (partial withdrawals can be made from the sixth year)

- Extension of PPF Account : After the maturity period (15 years), it can be extended for a period of 5 years

- Tax savings (contribution) : under section 80C (upto 1.5 L)

- Tax savings (interest earned and final amount) : fully exempted from wealth tax

Alternatives to Public Provident Fund

Www.ratekhoj.com

Although, PPF is a good choice in general but it may not be good for everyone. ELSS(Tax Saving Mutual Fund) is also exempted (EEE) like PPF. It can generate better returns (~15% or higher) but it's risky as compare to PPF. Read more detailed comparison here : PPF vs ELSS